Get Started With

servzone

Overview

The agricultural industry is the backbone of the Indian economy. 60% and population of India depends on agricultural activities for their livelihood. But these primary producers and farmers struggle a lot to gain their share. Keeping in mind his pitiable condition, the Government of India has brought out an Expert Committee, chaired by Y.K. Alagh to look into the case. In 2002, the committee brought the concept of producer companies to the Indian economy. Since then, he has been working for the upliftment of Indian farmers and agriculturalists (collectively termed “Producers”).

A legally formed company with the aim to improve the standard of living of farmers and agriculturists can be defined as a ‘Producer Company’. Producer Company is formed under the Companies Act 1956, and as per the act it can be formed by 10 individuals (or more) or 2 institutions or more or by a combination of both (10 individuals and 2 institutions) having one of the following as their business objective:

- Production

- Harvesting

- Procurement

- Grading

- Pooling

- Handling

- Marketing

- Export

- Selling

India is an agro-based country where more than 85% people depend on agricultural activities. Most farmers in India are small or marginal scale farmers with less than 2 hectares of land. Low production and poor facilities make their lives miserable and deprive them of the latest technologies. The producer company aims to empower all small and marginal scale farmers to unlock their economies and also select the latest and new technologies to live better and better lives.

To create a producer company, they have to obtain a producer company registration according to the rules and regulations.

Benefits

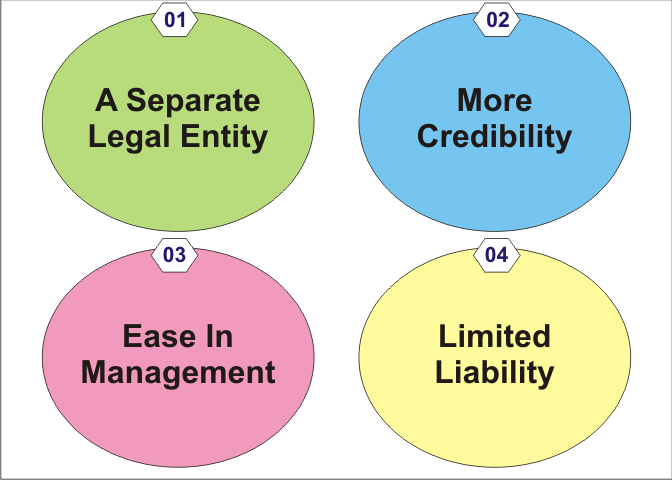

Some benefits:

- A separate legal entity

Like a private limited company, a registered farmer producer company is also treated as a separate legal entity, which can buy or sell land in its own name.

- More Credibility

Registered companies are offered more credibility than non-registered ones.

- Ease in Management

An applicant can make the desired changes in the management board by filling some simple form in relation to the Registrar of Companies (ROC)

- Limited Liability

Members' liabilities are limited, and their personal assets cannot be used to cover the company's debts and losses.

Required Documents

- From All Directors and Shareholder

1. PAN Card or Passport or Election ID Card

2. Latest Bank Statement/Telephone or Mobile Bill

3. Voter's ID/Passport/Driver's License

4. Passport-sized photograph of all directors and shareholder

- For Proposed Registered office (Residential or commercial)

1. Copy of any Utility bill

2. Scan copy of Rent agreement with NOC from the owner

3. In case of owned Property then copy of Property Papers.

Rules and Regulations for Loans and Credits

The main objective of the producer company is to raise the standard of living of primary producers in India. And to fulfill this purpose, a special provision was passed according to which loans will be sanctioned to the respective members of the producer company:

- Loans and Advances

By law, loans and advances will be issued to members of the producer company against protection for 7 years or less from the date of disbursement of loan.

- Credit Facilities

Credit facility will be given to the members of the manufacturing company for a period of 6 months or less..

- NABARD Loan

NABARD stands for National Bank for Agriculture & Rural Development that helps to meet the financial requirements of small and regional scale farmers. The members of Producer Company can obtain loans under the NABARD loan scheme.

Requirements

Before incorporation, the farmer producer company has to fulfil below-given requirements:

- There must be a minimum number of 5 directors and 10 members to incorporate the company

- The minimum paid-up capital should be Rs 5 lakhs or more to register a company

- There is no limit for the maximum number of members in a producer company

- Further, the company cannot be registered or considered as a Public Limited Company

- The company can only possess equity share capital

- The company must carry on 4 board meetings per year, and it should hold after every three months

Mandatory Requirement

Some mandatory requirement :

- Only a person or member engaged in activities related to the production of primary produce can participate in the ownership of the company.

- All the members should be primary producers

- The liabilities of the producer company members are limited to the amount of their unpaid share

- The name of the proposed company must contain “Producer Company Limited” at the end of their name.

- The proposed Producer Company is deemed as the private limited company as per the provisions of the Companies Act.

Registration Procedure

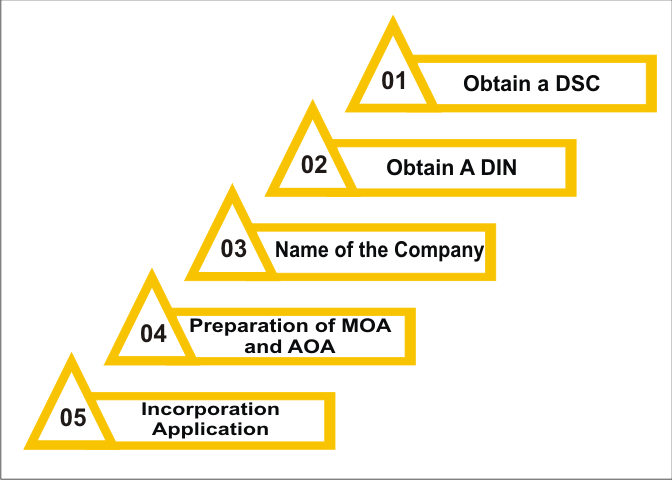

Just like a Private limited company, Producer Company is also registered as per the rules and regulations of the ministry of corporate affairs. The process is similar and starts with obtaining a Digital Signature Certificate or DSC and Director’s identification number or DIN for all the proposed directors of the company.

The incorporation application is filed in a prescribed format along with the required documents and MOA and AOA. If all goes well and the registrar is satisfied with the documents and the company receives a certificate of incorporation.

Following are the documents that an applicant would require at each step of the process:

- Obtain a Digital Signature Certificate or DSC

All the directors have to obtain a DSC, and for this, they require below given documents:

- PAN card of all the directors

- Aadhar card of all the directors containing the same information as per the PAN card.

- Passport size photograph of the directors

- Working Email address and Contact number

- Obtain the Director’s Identification Number

All designated directors of the company must obtain their DIN. As per the new rule, it can be obtained during the incorporation of the company through SPICe + form without applying for additional DIR-3 form.

- Preparation of MOA and AOA along with other documents

Once the name has been approved, the applicant must start the incorporation process by preparing the below-given documents:

- Memorandum of Association or MOA: it is drafted as per the objectives of the company.

- Article of Association or AOA: it is drafted as per by-laws of the proposed company.

- A declaration drafted by a professional

- An affidavit signed by all the proposed subscribers declaring their competency to act as legal subscribers of the company

- A utility bill such as electricity, gas or water bill with no objection certificate from the owner as residential proof of the company's respective office. In the case of rented property, a lease agreement must be attached to other documents.

- Incorporation Application

All formatted documents such as AOA, MOA, Affidavit, and Manifesto will be attached to the SPICe + form with the relative registrar of companies. After that, all documents and applications are verified by higher authorities.

Verification of documents will take about 7-15 days. If all is in accordance with the requirements of the ROC, the certificate of incorporation will be issued to the company.

Tax Exemptions

The registered producer company gets tax benefit as an exemption from agricultural income under section 10 (1) of the Income Tax Act, 1961. This exemption varies depending on the activities undertaken by the farmers such as 100% exemption from agricultural income tax. While the income earned from production of green tea is 60% exempt as per law.

All these benefits make producer company registration more profitable for all farmers in India. This helped them in higher production and better credit facilities, thus benefiting more for their produce. All producers are happy in the company for all farmers in India.

Note: According to the Companies Act, 1956, primary production is a product produced from a farmer's agricultural land, such as floriculture, horticulture, animal husbandry, re-vegetation, vitamisks, fisheries, beekeeping, forest products, forestry and agricultural products.

GST Registration

PVT. LTD. Company

Loan

Insurance